Coverage limits, deductibles, endorsements, policy number and policy term, are also listed on the declarations page. It includes vital information about the insurance company and policy, including the named insured, property location and the selected coverage. Some insurance companies automatically include replacement cost for dwelling and personal property coverage, while other companies require it be added as an endorsement.Ī homeowners insurance declarations page is a snapshot of the home insurance policy. Actual cash value considers depreciation when determining your claim payout amount. With replacement cost value, the home or personal property will be covered for the cost to replace what is damaged in a covered loss at the time of the claim, without depreciation. Replacement cost value versus actual cash valueįor dwelling and personal property coverage, either replacement cost or actual cash value applies. Provides medical coverage if a guest is injured on your property, but you are not legally responsible for covering the costs of injuries. Protects you if you (or your pet - restrictions may apply) cause injuries to or damage someone else’s property and are financially responsible for covering the costs. If you and your household members are temporarily displaced from your home due to a covered loss, this coverage helps cover the costs.

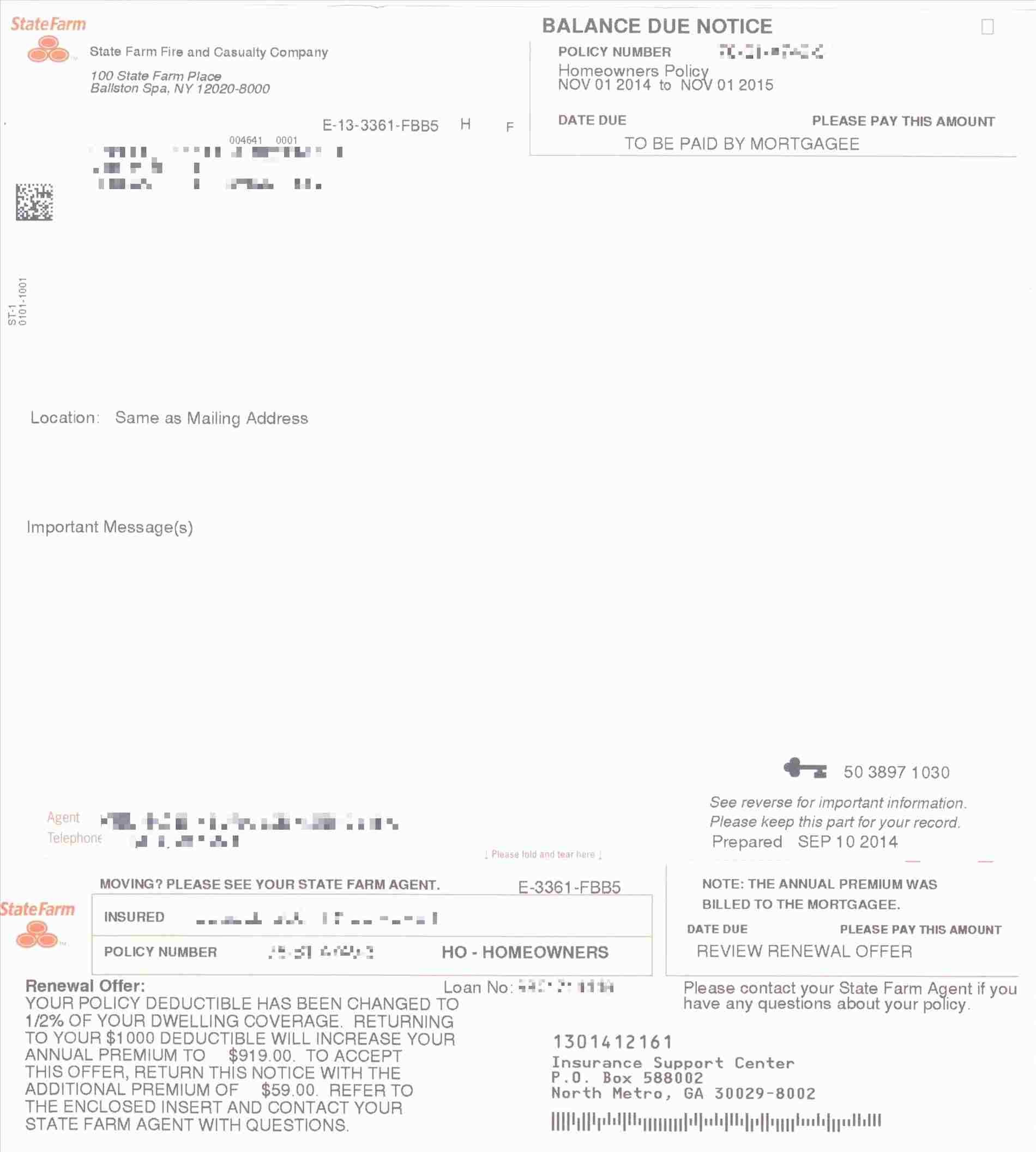

Provides coverage for structures detached from the dwelling, like a fence, shed, barn or gazebo, if damaged or destroyed in a covered loss.Ĭovers your personal belongings in the home and often extends some coverage for personal belongings stored in other locations, like a storage unit. Provides financial protection to repair or rebuild your home’s structure if damaged or destroyed in a covered loss. However, depending on your carrier, you may be able to increase some of these limits or add other endorsements to further personalize your policy. The central element is dwelling coverage, and many other standard coverage options are usually a percentage of this dwelling coverage amount. The parts of a homeowner insurance policyĪ homeowners insurance policy includes a variety of coverage types, each one with its own monetary coverage limit. It is helpful to read it first so you understand the terms you will see on the declarations page. The policy jacket, or policy form, is included with the declarations page, and it goes into even more detail with policy language, such as exclusions and conditions, as well as definitions of important terms. It will have information related to your policy, such as the insurance company’s name, your name, property address, coverage amounts, deductibles, endorsements and annual premium. It’s generally a single page or two at most. The declarations page is the most important page when trying to understand your homeowners insurance policy.

#Homeowners declaration page how to

How to read and understand your home insurance policy Homeowners should also be aware that home insurance policies typically exclude certain types of property damage. Understanding replacement cost versus actual cash value is important to know how your homeowners insurance claim would be settled. The main parts of home insurance policy documents are the declarations page and the policy jacket. Knowing how to read a home insurance policy might help you choose the appropriate coverage and evaluate your policy as your needs change. Bankrate’s insurance editorial team has nearly 50 years of combined experience in the industry and includes three licensed insurance agents, so we can help you understand the details of your home insurance policy.

Home insurance policies may seem complex, but they don’t have to be. Buying home insurance is an important part of your financial plan as a homeowner, and knowing how to read and understand your coverage is an integral step.

0 kommentar(er)

0 kommentar(er)